(日本語ブログ:なぜ、海外投資家は日本株を過小評価するのでしょうか? | One World Link)

Are you happy with the response your company’s English disclosures receive from overseas stakeholders? Do you struggle to gain the confidence of overseas investors?

A 2023 survey conducted by the Tokyo Stock Exchange (TSE) revealed that 72% of overseas institutional investors are dissatisfied with the current state of English corporate disclosures in Japan. This survey targeted mainly institutional investors in the United States, the United Kingdom, Continental Europe, and Asia-Pacific, all of whom pointed to delays and the absence of English materials for small- and mid-cap companies as primary reasons for their dissatisfaction. (TSE Survey)

In response to such mounting criticism, the TSE announced that companies listed on the TSE Prime Market are required to simultaneously disclose material corporate information, including financial results and timely updates, in both Japanese and English beginning April 2025. This new regulation aims to address longstanding concerns from foreign investors, who often rely on English disclosures as their primary source of investment information.

Let’s take a further look into what overseas investors struggle with and why.

Investor Testimonials

Open-ended responses from overseas institutional investors pointed to several common issues, mainly the timing, amount, and quality of disclosure translations.

One respondent working in research at a U.K asset management company wrote, “Lots of the companies disclose much less information in the English disclosure, and even if so, the disclosure timing is 2-3 weeks later compared to the Japanese disclosure. This disclosure timing difference creates huge investment opportunity cost for us.”

“Disclosures have greatly improved overall, but there is still room for more improvement. Many small and mid-size companies, especially smaller ones do not have equally detailed English investor relations information, such as investor presentations.” -US asset management company

“Often times when the disclosure in Japanese is much better than English” -Asset management company in continental Europe

One quote from a U.S. asset management company summarizes the general trend.

“I believe it’s much harder to evaluate the risks of an investment in Japan compared to elsewhere in the world.”

The Unfortunate Result…

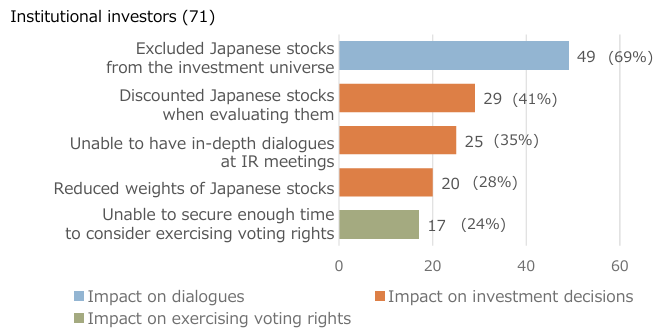

The 2023 TSE survey indicated that 41% of respondents valued companies with inadequate English disclosure at a discount, 35 % excluded such companies entirely from their investment universe, and 28% reported reducing the weights of these companies in their portfolios.

Figure 1

Q.What kind of consequences have you experienced due to inadequacy of English

disclosure?

(Source: TSE Survey)

These findings reveal the direct impact of poor English disclosures on investor behavior and, by extension, the valuation of Japanese stocks.

What should you focus on in April?

It’s one thing to understand these issues; knowing where to begin is another challenge entirely. The TSE regulations in April 2025 require Prime Market-listed companies to disclose the following information.

- Financial Results: This includes annual, semi-annual, and quarterly earnings reports. The simultaneous disclosure ensures that all investors have equal access to a company’s financial performance data.

- Timely Disclosure Information: Material events that could influence investment decisions, including:

- Earnings Forecast Revisions: Updates to projected financial performance.

- Mergers and Acquisitions: Announcements of significant corporate restructuring or business combinations.

- Changes in Executive Leadership: Notifications regarding alterations in key management positions.

Note that the TSE regulations going into effect will permit companies to provide summaries or excerpts of the Japanese disclosures in English, provided these disclosures cover the essential information necessary for investor decision-making. (JPX News Release)

For companies struggling with English language disclosures, this is a great first step. But the question remains… is this enough?

As mentioned earlier, investors look for full translation. A significant number of open-ended responses from the aforementioned survey indicate that many investors are dissatisfied with only being provided summaries and shortened disclosures. One respondent mentioned “We see some more companies filing various reports in English, but we are dissatisfied with companies still only publishing short versions of the Tanshin report in English, for example.”

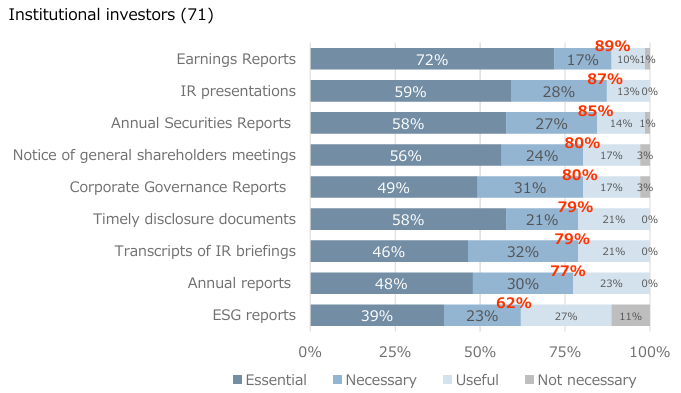

Additionally, Respondents to the TSE survey indicated that, in addition to earnings reports, they look to base investment decisions on IR presentations (87%) and annual securities reports (85%). See Figure 2 for a more detailed list of investors’ priority.

Figure 2

Q. Please select one of the following items for each document to determine whether

disclosure in English by listed Japanese companies is necessary when investing in

those companies (a), and the timing at which they are needed relative to the

Japanese release (b).

(Source: TSE Survey)

Understanding which documents overseas investors look for can make of break a company’s efforts to expand overseas.

To Conclude

The upcoming changes are not just a regulatory adjustment but also a critical opportunity for Japanese companies to rebuild investor trust. Prioritizing high-quality, timely English disclosures will allow companies to enhance their global reputation, attract institutional investors, and improve stock valuations.

While the shift may present initial challenges, taking proactive measures to adapt will help you position your company as a leader in transparency and global engagement. In an increasingly interconnected world, the ability to tell a company’s story effectively is not just a competitive advantage; it is an expectation.

>>Tune in to our February edition to learn more on what investors say about the quality of translated disclosures.

Jessica Azumaya

最新記事 by Jessica Azumaya (全て見る)

- Are You Using Incorrect English in Japanese Design? - 12月 15, 2025

- One Easy Way to Make Your English Writing Appear More Natural - 12月 13, 2025

- Why Using a Consistent Theme for Integrated Reports Strengthens Your Global Message - 12月 11, 2025

- Why Vertical Japanese Text Design Ruins English Reports - 12月 9, 2025

- Writing Is More Than ‘What’ You Say - 12月 5, 2025