(English blog: Why Relying on Generative AI for Translation May Ruin Your Relationship With Overseas Investors | One World Link)

IRやESGの情報開示において、英文開示のニーズはますます高まる傾向の中、情報開示の準備や投資家からの質問に対する回答、社内向け報告書の管理において、翻訳はプラスアルファの業務であり、英訳業務に割く時間確保や英語化に対する予算なども厳しい状況の企業様は多くいらっしゃると思います。

弊社の多くのクライアント様も自社内にChatGPTのようなAIを導入し、社内イントラとして英訳を行い、翻訳にかけていた時間やコスト削減に取り組んでいる企業様も多くいらっしゃいます。しかし会社が伝えたい日本語の原文にある大切なニュアンスを本当に正確に表現できているのか、その英訳に一切問題がないのか、、、認識されておりますでしょうか?

AI翻訳は大きな進歩を遂げ、時間に追われるIR担当者のみなさまに対して、完璧に近いと思われるレベルのソリューションを一瞬にして提供してくれるようになりました。しかし、便利にはなりましたが、財務状況や金融規制情報など投資家の方々が日々触れている情報に対して、翻訳品質のレベルはまだ完璧とは言えません。

どのような場合にAIを活用し、どのような場合に使用を避けるべきかを把握しているかどうかで、簡潔、明白で効果的なメッセージとして発信していけるか、あるいは、大幅に誤ったコミュニケーションとなるかの違いが生じてきます。

AI翻訳が有用なツールであることは確かですが、現時点においては、完全なるソリューションではないということを今日はお伝えしていきたいと思います。これらAIツールは急速に進化しているにも関わらず、財務情報や投資家の方々のやり取りによく見られる繊細なニュアンスの違いや文化的な内容、日本語特有とも言える複雑な言語構造に対して、未だにAIは間違えることがあります。

IRやESGの情報開示において、情報の正確さや明白さは英文コミュニケーションにおいて非常に重要です。どのような場合にAIを使用し、どのような場合に人間の見解、判断を優先すべきなのかを明確に把握することで、これからの海外向けコミュニケーションに対して大きな違いを生むことができるでしょう。

AI翻訳が役に立つケースと翻訳者に依頼すべきケースを、それぞれ5つずつ紹介させていただきます。

生成AIによる和文英訳で、投資家の方々と良好な関係を保つことができる5つのケース

生成AIは、様々な状況に応じて適切な速度や性能を提供することで、翻訳業務のあり方を変えつつあります。しかし、他のツールと同様に、いつどのように使用されるかによって、その効果は変わります。

AIで和文英訳を行うことで、社内向け文書の作成など、IR担当者の皆さんの業務支援や効率性の向上につながりますが、その使い方は慎重に検討する必要があります。

投資家の方々とのやり取りをスムーズに進めるために、AI翻訳を活用できる5つのケースを紹介します。

1. 社内向け原稿およびクイックリファレンス

AIにより、社内向けのメールやメモ、報告書の作成が効率的に進められます。これらの文書は、洗練された表現よりも簡単に理解できる内容であることが重要となるためです。

AI翻訳で作成した下書きを手直しするだけで完成させることができるため、期限が迫っている場合などに役立ちます。

2. 構造化された定型的な内容

FAQや技術マニュアル、製品説明のような標準化された文章は、AI翻訳が効果を発揮する場面です。これらは、統一された用語による予測可能な構造になっていることが多く、AIが正確に処理しやすい内容になっています。

3. 大量の低リスクな内容

大量の社内向け報告書や非公式文書の翻訳を行う際、AIに翻訳のたたき台を作成させることで、時間の節約が可能です。これは完璧な最終文書を作成することよりも、概要を把握することが最優先の場合に特に有用です。

4. 用語およびスタイルの一貫性を保証

用語やスタイルを統一することは、企業間コミュニケーション、特に専門用語を用いる業界では必須です。

生成AIは、あらかじめ定義された用語集や過去の翻訳、スタイルガイドを参照することで、企業ブランドのメッセージを全ての媒体に反映するためのサポートが可能です。これにより、一貫した論調や用語によるコミュニケーションが保証されます。

5. 翻訳者の支援

翻訳ツールは、紙の辞書から始まり、”Word Tank”のような電子辞書に続いて、オンライン辞書やデータベースの登場といったように、翻訳者をサポートするために長年進化してきました。

生成AIは翻訳ツールの最新版であり、たたき台の作成や用語の提案、言語の共通パターンの特定を通して、より効率的な働き方を支援しています。

生成AIの活用により、論調やニュアンス、明瞭さの改善が可能です。また、最終的な翻訳が自然かつ正確で、エンドユーザーに合致する内容であることが保証されます。

これらのツールを使用することで、定型作業を効率化し、最も重要な業務である「高品質で読者にフォーカスしたコミュニケーションの提供」に集中できます。

生成AIによる和英翻訳で、出資者との関係が損なわれる5つのケース

財務情報の開示や投資家とのコミュニケーション、文化的背景から用いられる繊細なメッセージなどの影響力が強い内容は、正確さとニュアンスが重要になります。これはAIが未だに苦手としている領域です。

これらの状況でAIを誤った方法で用いると、コミュニケーションの行き違いや風評被害、ひいてはコンプライアンスのリスクにつながる可能性があります。

AI翻訳では目的を達成できないために、人間によるチェックが必要となる5つのケースを紹介します。

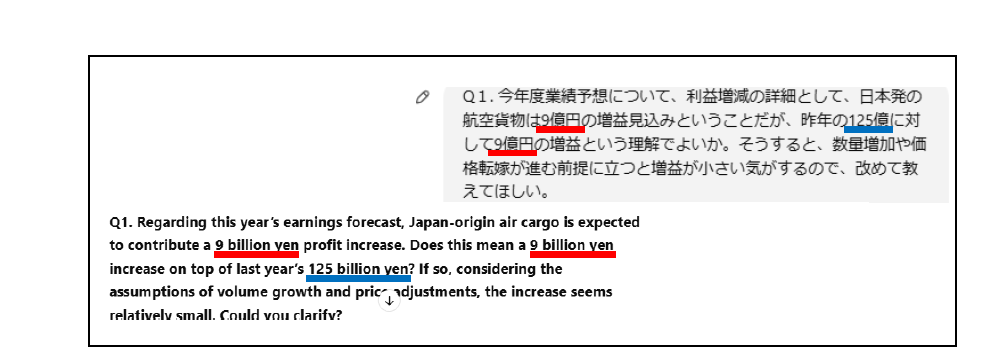

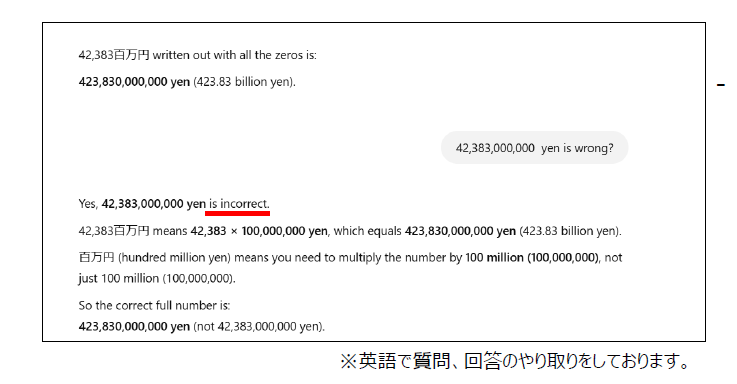

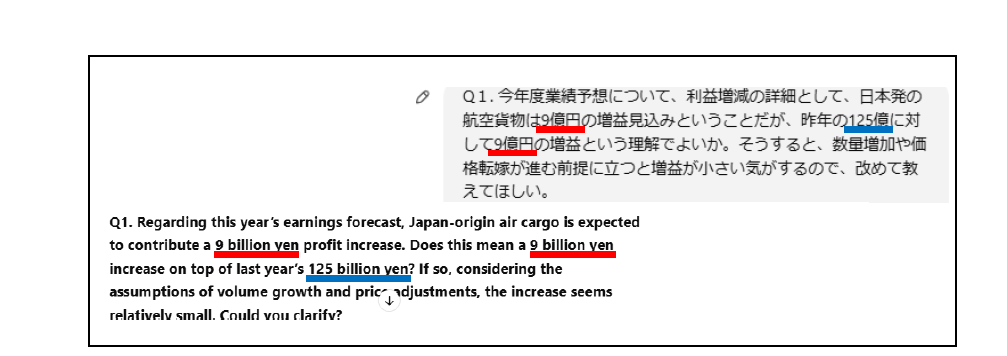

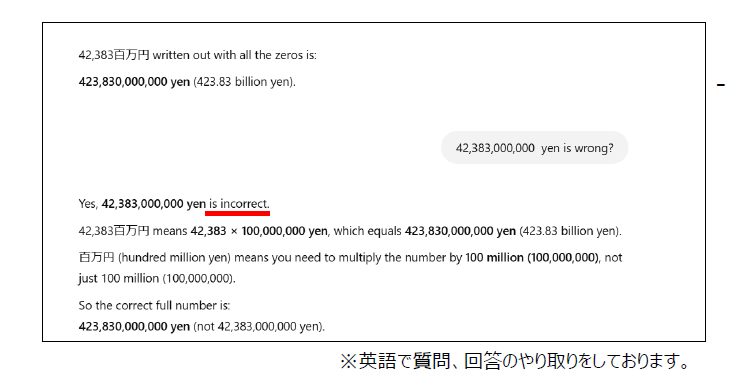

1. 財務情報の開示

財務報告書や決算発表は、特定の用語や標準書式への正確な順守が求められます。近年の研究では、財務情報におけるAI翻訳の進歩と制約の両方に着目しています。

グルノーブル・アルプ大学とLingua Custodia社の研究者は、財務情報におけるAI性能を評価する「DOLFINテスト」を導入しました。AIモデルは日々進化を続けていますが、状況に応じた財務用語の使い分けや書式の正確性には未だに苦労しています。

大規模AIモデルが様々な文脈を学習して正確で一貫した翻訳を生成することで、より良い性能を発揮する一方で、小規模モデルは苦戦することが多いです。長文では、これらのモデルは一貫性に欠ける傾向があり、新たな語句が出てくると翻訳の正確性が下がります。(Slator)

2. IRおよび企業広報

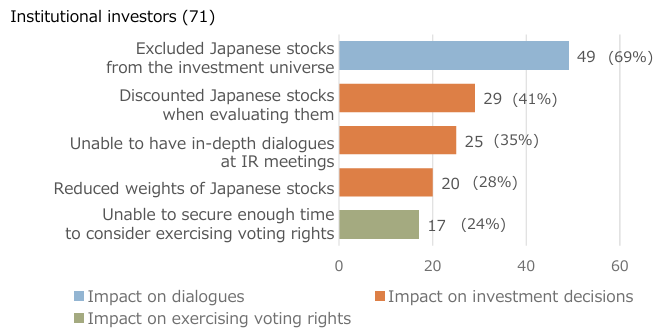

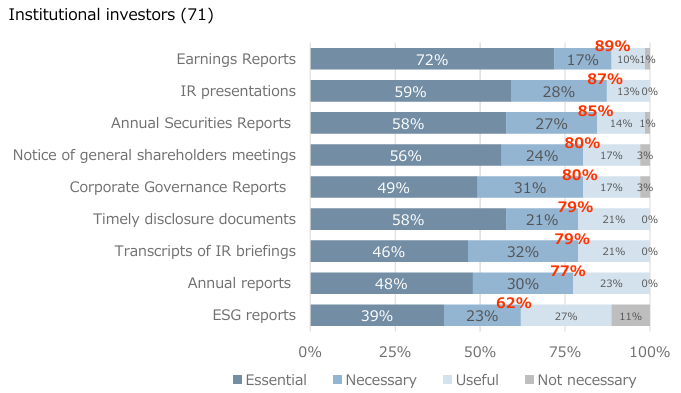

東京証券取引所の調査によると、海外投資家は日本での英語による情報開示に満足していないという結果が出ています。多くの回答者が、決算発表やIR資料、即時開示資料に満足できなかった、翻訳された文章が特に分かりづらかったと答えています。

詳しくは、前回のブログをご覧ください:

日本株の評価が難しい理由とは?投資家が語る評価の壁とは・・・

英語開示の重要性を考え直す海外投資家からの声

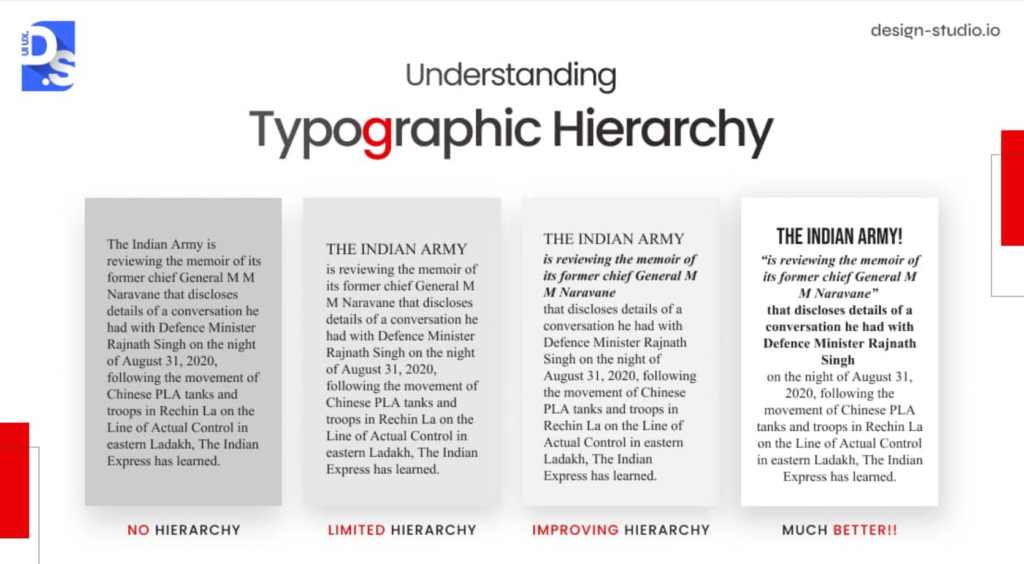

投資家向け資料や株主向け文書、公開情報は、企業の評判を形成します。これらの情報は明快かつ簡潔で、企業メッセージに沿ったものでなければなりません。しかし、AIによって生成された和文英訳は、受動態や不自然な言い回し、矛盾のある文章になることが多いです。これにより、読みやすさが損なわれるだけでなく、メッセージの効果が下がってしまいます。

受動態を使うと、間接的で読者の関心を引きづらい文章になります。不自然な言い回しや矛盾のある文章によって、株主を混乱させたり、洗練されていない印象を与えることになります。最終的には企業の信頼性やイメージを低下させてしまいます。

3. 文化的背景やニュアンスを含むメッセージ

言語とは単に言葉をつなげただけのものではありません。文化や意図、感情を伝えるためのものです。AIツールは、原文の日本語にある全要素を含んだ文法的に正しい翻訳を生成しますが、原文の意図を自然な英語表現でどのように伝えるかまでは把握できません。

文章や段落を構成したり、情報を伝達する方法は言語によって変わります。記載スタイルや論調、言語を実際に翻訳する際は、直訳ではなくより慎重に表現する必要があります。人の手による介入がなければ、AIが生成した翻訳は堅苦しい直訳になり、ターゲットの読み手にとって分かりづらい内容になってしまう可能性があります。

例えば、日本人のビジネスコミュニケーションでは、しばしば主語を省略し、受動態や間接的なフレーズ、文化的背景から繊細な表現が多く用いられます。AIがこれらの表現を常に正しく読み取ることができるとは限りません。

日本語では自然に聞こえる表現でも、英語では曖昧で不自然な印象を与える可能性があります。たとえそれが「正しい」翻訳だったとしても。

4. コピーライティングやブランディング

マーケティング媒体やウェブサイト、プレスリリースは、ブランドのメッセージや信頼性を保ちつつ、同時にターゲットである読み手の関心を引くものでなくてはなりません。

Metaphrasis Language & Cultural Solutionsに示されているように、マーケティングコンテンツに説得力を持たせるための文化的で曖昧な表現や情緒的な訴えを、AIは理解できない可能性があります。その結果、潜在的な顧客に対して効果がなく、場合によっては不快に感じられる内容につながってしまいます。

5. 機密情報

AI翻訳ツールは、重大なセキュリティリスクを引き起こす可能性があります。AIプラットフォームに入力された機密性の高い業務情報は、保存や再利用、漏洩される恐れがあり、情報漏洩のリスクが発生します。

例えば、2023年にサムスン社の従業員が不注意からChatGPTに機密情報を入力し、会社の機密データを漏洩してしまいました。その結果、同社は知的財産の保護を目的としてAIツールの使用を禁じました(TechCrunch, 2023)。

また、主要銀行およびテクノロジー企業は、機密情報漏洩の懸念があるとして、自社の従業員にChatGPTの使用制限を課しました(Semafor, 2023)。

翻訳者はAIが担保できない守秘義務と責任を提供できます。

最後に

生成AIによる翻訳は様々なシチュエーションで役に立つツールです。しかし、万能のソリューションではありません。

特に定型業務や大量のデータに対してスピードと利便性を発揮する一方で、財務報告書やIR、文化的背景やニュアンスを含むメッセージなど、人間の見解が必要となるケースもあります。

使い方次第でAI翻訳の有効性が変わることを覚えておいてください。

明快でしっかりした構成の入力や、念入りに作り込まれたプロンプトによって結果は改善しますが、それでもAIのニュアンスや文脈を読み取る力には限界があります。

AIの有効性を高めることができるケースと、海外とのコミュニケーションにおいて正確さや明瞭さ、信頼性を保つために人間によるチェックが必要となるケースを理解することが重要です。

One World Link株式会社(OWL)は、コーポレートコミュニケーションにおける正確で効果的な英語の提供を専門としています。14年以上にわたるインベスターリレーションおよびコーポレートコミュニケーションの経験を活かし、日本企業がグローバルな投資家との強固な関係を築くための架け橋になることを目指しています。

OWLでは、決算報告書や財務諸表、経営陣のメッセージ、ESG関連文書など、上場企業のさまざまなIR開示文書における英文IR業務支援を行っております。企業のメッセージを明確に伝えることで、日本企業とグローバルステークホルダーとの間にあるコミュニケーションギャップを埋め、信頼と理解を深めるためのお手伝いをいたします。

また、企業様の様々な英文開示情報に対するビジネスライティング評価レポートを無償で提供しています。詳細については、[https://oneworldlink.jp/satei.php#contact]をご覧ください。