(日本語ブログ:今知っておくべきESGキープレーヤー10選|One World Link)

The landscape surrounding ESG (Environmental, Social, and Governance) is shifting rapidly, and Japanese corporations can’t afford to fall behind. With global investors demanding greater transparency and Japan’s mandatory simultaneous disclosure regulations taking effect in April 2025, understanding key ESG frameworks isn’t just important—it’s essential for maintaining credibility and competitiveness.

Why This Matters to You

As an IR professional, you are responsible for ensuring your company’s financial disclosures meet international standards. Overseas investors expect clear, high-quality ESG reporting that aligns with frameworks like ISSB, TCFD, and GRI.

If your disclosures are inconsistent or fail to meet expectations, it could damage investor confidence and impact your company’s valuation. Understanding these ESG standards will help you navigate evolving regulations, boost investor trust, and position your company as a leader in sustainable business practices.

The following is a partial list of the main global organizations that control the rules for ESG disclosures for publicly traded companies around the world.

1. International Sustainability Standards Board (ISSB)

https://www.ifrs.org/groups/international-sustainability-standards-board

- Function: Develops a global baseline for sustainability reporting.

- Key Standards: ISSB issued the IFRS Sustainability Disclosure Standards (S1 and S2), effective from 2024, to ensure consistency in climate-related and sustainability-related disclosures.

2. Global Reporting Initiative (GRI)

https://www.globalreporting.org

- Function: Provides the most widely used framework for sustainability reporting.

- Key Standards: GRI Standards cover economic, environmental, and social impacts, helping companies report on their broader ESG performance.

3. Sustainability Accounting Standards Board (SASB)

- Function: Develops industry-specific sustainability disclosure standards.

- Key Standards: SASB Standards identify financially material ESG issues for different industries.

- Integration: SASB is now part of the Value Reporting Foundation (VRF), which merged into the ISSB in 2022.

4. Task Force on Climate-related Financial Disclosures (TCFD)

(Disbanded as of Oct. 12, 2023. Monitoring now conducted by ISSB of IFRS.)

- Function: Provides a framework for climate-related financial disclosures.

- Key Standards: TCFD recommendations focus on governance, strategy, risk management, and metrics related to climate risks.

- Regulatory Adoption: Countries like the UK, EU, Japan, and Canada have mandated TCFD-aligned disclosures.

- The ISSB’s standards, IFRS S1 and IFRS S2, fully incorporate the TCFD recommendations, providing a comprehensive framework for sustainability and climate-related disclosures.

5. European Financial Reporting Advisory Group (EFRAG)

- Function: Develops the European Sustainability Reporting Standards (ESRS) under the Corporate Sustainability Reporting Directive (CSRD).

- Impact: Requires large and listed EU companies to disclose ESG performance starting in 2024.

6. United Nations Principles for Responsible Investment (UN PRI)

- Function: Sets voluntary ESG disclosure principles for investors.

- Key Standards: Encourages companies to integrate ESG factors into investment decision-making.

7. CDP (formerly Carbon Disclosure Project)

- Function: Manages global disclosure systems for environmental impacts.

- Key Standards: Focuses on climate change, water security, and deforestation disclosures.

8. U.S. Securities and Exchange Commission (SEC)

- Function: Regulates ESG disclosure for publicly traded companies in the U.S.

- Key Rules: Proposed rules for climate risk disclosures, aligned with TCFD recommendations.

9. International Organization of Securities Commissions (IOSCO)

- Function: Supports global securities regulators in aligning ESG reporting frameworks.

- Key Role: Endorses ISSB standards to promote global adoption.

10. Stock Exchanges and National Regulators

Japan:

Japan’s Financial Services Agency (FSA) https://www.fsa.go.jp/en/

Tokyo Stock Exchange (TSE) https://www.jpx.co.jp/english/

- Purpose: Regulates ESG disclosure requirements for publicly traded companies in Japan.

- Key Rules: The FSA has mandated TCFD-aligned disclosures, and the TSE encourages listed companies to improve ESG transparency in their corporate governance reports.

- Impact: Companies must integrate ESG factors into their financial reporting to comply with new regulations and attract foreign investment.

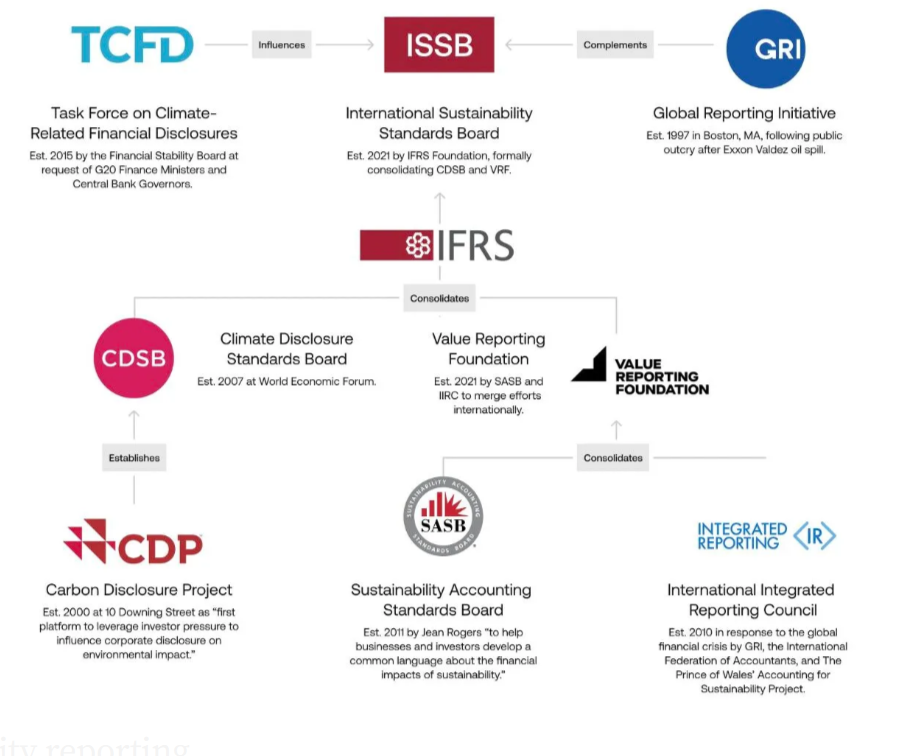

Visualizing ESG Disclosure Convergence

The ESG reporting landscape is undergoing significant consolidation. The ISSB is leading the effort to integrate various ESG disclosure frameworks into a unified global standard. The TCFD’s climate-related disclosure principles have directly influenced ISSB’s IFRS Sustainability Disclosure Standards (S1 & S2). Additionally, SASB and the Value Reporting Foundation (VRF) were merged into ISSB, while GRI remains a complementary framework.

Source: ESG Professionals Network. An Infographic of the ESG Reporting Landscape.

This visual highlights the key players shaping ESG reporting today, reinforcing the importance of aligning with ISSB’s emerging standards.

Implications

Given these developments, it’s crucial for IR professionals in Japan to:

- Stay Informed: Regularly update your knowledge on global ESG reporting standards to ensure compliance and meet investor expectations.

- Engage in Harmonization Efforts: Understand how global standards align with local regulations, especially with Japan’s commitment to TCFD-aligned disclosures.

- Enhance Reporting Practices: Leverage the consolidated frameworks to provide transparent and comprehensive ESG disclosures, thereby boosting investor confidence and aligning with global best practices.

Jessica Azumaya

最新記事 by Jessica Azumaya (全て見る)

- Are You Using Incorrect English in Japanese Design? - 12月 15, 2025

- One Easy Way to Make Your English Writing Appear More Natural - 12月 13, 2025

- Why Using a Consistent Theme for Integrated Reports Strengthens Your Global Message - 12月 11, 2025

- Why Vertical Japanese Text Design Ruins English Reports - 12月 9, 2025

- Writing Is More Than ‘What’ You Say - 12月 5, 2025